Uncategorized News

Uncategorized News

Why is now a good time to invest in a hospitality business?

Investors must always strike at opportune times. It’s a process that requires a great deal of foresight and strategy, as the right move at the right opening can enable stakeholders to reap a bevy of financial rewards.

Consequently, where hospitality businesses are concerned, the best time to move forward with an investment is now.

But after all this time, why now? Well, some have succeeded enormously in hospitality despite failures early in life – why not get in on the action somewhat?

Consequently, here’s a few reasons why you should make your move in this arena right now.

An active industry

It’s no secret that Brexit is coming up sooner or later, and many businesses are holding their breath and stagnating until the black cloud passes. The hospitality industry is taking a different tactic; working as hard as possible and staying busy to weather the storm instead. While other industries are taking a hit already, tourism and travel in the UK is something that’ll likely never falter.

Therefore, the industry will be consistently proactive in the future in this regard. There’re many famous landmarks and tourist spots that millions of people visit every year, so investment into travel and tourism would likely prove lucrative. At the very least, hospitality is one of the few industries that, while concerned, isn’t rendered immobile and ineffective by their fears.

A sustainable industry

The hospitality industry is also sustainable in its operations. Businesses in this field will go to great lengths to things like recycle and be environmentally friendly, or make careful use of water waste for other means.

While this might seem like a minor thing, it displays that hospitality businesses are forward thinking and always try and better the way they do things. It also makes them media friendly, and favourable in the eyes of the public.

Industries that aren’t afraid to evolve with the times always make for the best investment playgrounds. There’s new technologies, new methods, new rules and regulations that shape and mould how they do their business.

Once again, this plays on the theme of avoiding stagnation, and gives investors plenty of additional sectors to pump their resources into that develop alongside them. New needs are constantly in circulation that investors can have a hand in funding.

Social media

These days, it seems like everyone has social media. However, businesses obviously use it differently to how the average joe does. It’s their outreach channel, and their means of communicating with customers.

Not only this, but its’s also a research tool, enabling firms to keep an eye on market trends and to track their competitor’s strategies. Ultimately, social media is an all-seeing force here.

Ultimately, this is just another way that the hospitality industry keeps moving forward while never looking back. The sector has a great deal of influence over its customer base, and with the right strategies, can inspire and bend willing customers to their will.

Once again, it’s also another sub-sector in the industry, and as technology is constantly progressing, investment opportunities will forever be plentiful here.

Conclusion

The hospital industry will always offer viable investment opportunities due to one key factor; change. It doesn’t shy from it in any of its forms. This, in turn, opens up further avenues for investors to explore, and enables them to be a part of these recurring periods of seismic and profitable evolution.

Source:

https://www.bmmagazine.co.uk/in-business/why-is-now-a-good-time-to-invest-in-a-hospitality-business/

How Technology Will Impact The Restaurant Industry

Technology surrounds us, impacting every part of our daily lives. From communicating with friends and family to paying for groceries, technology is being used to simplify processes and make them more convenient. It’s been used with great success in the restaurant trade too. Things like POS systems, tabletop tablets for self-ordering and inventory tracking systems are streamlining mundane and repetitive tasks.

While there is definitely some positive impact technology can have on restaurants, there’s no denying that the restaurant experience is still mainly driven by human interaction. And, for the foreseeable future, it looks like it will remain this way.

But this raises an interesting question: What role should technology play in the restaurant experience?

Customer Experience

People have written extensively about the role of technology in business. One such author, Jim Collins in his book ‘Good to Great,’ states that great companies are the ones who understand how technology can be used to enhance their offering. That’s an excellent point. Technology should only be incorporated into a restaurant if it can improve the customer’s or staff’s experience.

Most people visit a restaurant because of two reasons; the convenience of having food served to them immediately, and, for the feeling of joy they experience when they’re being looked after while sampling delicious food and drink.

So, if convenience is at the heart of a restaurants offering, then technology should have a central role. Examples of brands who are doing this really well include EKIM, a French food start-up who have recently raised substantial investment for their robot pizzeria concept. Another example is San Francisco based Café X, who use robots as a replacement for baristas.

It’s possible, that this is a glimpse of things to come. Spyce is a concept that has been developed by graduates from the Massachusetts Institute of Technology. It involves robots instead of chefs cooking complex dishes. Using robots means the restaurant’s overheads are kept to a minimum, so they can sell their dishes for as little as $7.50.

While convenience is great, there is still a question of how technology can add to the ‘joy’ that people experience when eating in a restaurant. The main benefit of using a robot is that they can automate time-consuming and repetitive tasks. But the downside is that they add very little to a customer’s main experience i.e. being looked after by attentive staff who serve tasty food.

If robots are used to provide this service, once the novelty has worn off, are you left with an experience that people are bored by?

It will be interesting to see what the answer to this question is. However, there are already examples of restaurants who are successfully using technology to offer convenience and joy. One such restaurant is Inamo. The incorporation of self-ordering technology means their customers can be served quickly. And at the same time, this technology is creating an interactive environment which appeals to its core audience.

This concept is definitely working as their Camden branch was voted ‘Best Local Restaurant’ by Time Out. It will be interesting to see how this brand reacts to developing technology and how it plans to incorporate any of this into its branches in the future.

Staff experience

It’s also worth looking into how technology impacts the restaurant staff. Technology can play a hugely positive role in helping staff to perform their duties more efficiently, so their time is freed up to focus on serving customers or training and mentoring junior team members.

So, if you are thinking of incorporating technology into a restaurant, you should ask yourself these things first:

Does technology complement the main purpose of the restaurant? i.e. what is it that makes people want to visit the restaurant?

Will technology enhance the ‘convenience’ factor of the restaurant for both the customers and staff?

Will technology add to the feeling of joy of visiting or working in the restaurant?

So, will robots be running restaurants soon? Probably not. But it’s quite possible that their use in a restaurant environment may help to create a positive experience for customers and staff, alike.

Object Space Place is a London based restaurant interior design company, with a focus on storytelling and craftsmanship. They work with both brands and private individuals to create rich and enjoyable spaces and thriving businesses.

Source: https://www.hospitalityandcateringnews.com/

Prioritizing technology for your hotel staff

In the last few years, there has been a steady uptick in integrating the use of technology within the hospitality industry. Hotels are now heavily investing in guest-facing technologies such as booking engines, mobile apps, digital concierge services, keyless entry systems, beacons, automated check in and check out processes amongst many other, especially for their guests. In a recent New York Times article, Scott Dobroski, of corporate communications for Glassdoor, says that ‘All companies are becoming technology companies to some degree, and this is especially true in the hospitality industry’.

This phenomenon is definite progress for the hospitality industry, and it is time to shift the focus on adapting mobile technologies for your employees too. Stefan Tweraser of Snapshot writes about how employees are using multi faceted systems that can affect productivity and even shrink job satisfaction. These systems are so complex that guests are left waiting while employees navigate the user interface for information – information that should be mobile, on their fingertips and readily available at any given point of the day. Mobile technologies that allow for internal connectivity, communication, access to all information can be extremely valuable for operations and in-house staff.

A mobile platform can provide more benefits due to its flexible nature. For instance, staff members have instant access to the company intranet allowing them to provide enhanced service to guests. Gaining that access to daily news and real time updates increases their ability to work efficiently and with complete information. On the other hand, management can use employee behaviour data to optimise their operational processes. The key is to find technology that will save your employee’s time in doing routine tasks with all the required information to perform their job, available for their use at any time along with giving managers access to gather and analyse staff data. It will fit your operational purpose with simplicity in function and adaptability and most importantly, help improve your strategic goals and bottom-line.

By finding platforms that are multifaceted and provide different features to tie your operational processes together, it could provide valuable data into how staff carries out their work, and how it affects factors such as employee retention, satisfaction and productivity. These metrics have a direct impact on guests as well as the bottom line.

Features such as communication could include sending out daily updates regarding VIP guests or check in’s or having a portable database with documents on security, personnel HR, training, employee marketing and departmental reports. These enable staff to remain informed at all times, stay updated with recent knowledge and skills allowing them to do their tasks optimally and provide impeccable guest service. Just by using such a feature, guest satisfaction and retention can increase; along with productivity, again, positively affecting the bottom-line.

Added features such as surveys and feedback provide management with the opportunity to engage with their teams and have open dialogue frequently. Managers can respond faster to employee feedback, take action, and create a sense of community. As a result, employee retention boosts, satisfaction surges and the costs of hiring are reduced!

Bonus functions such as chatting, conducting assessments, filling checklists and inventory lists allow for optimising operational processes, reduced paper trails and collecting analytical in-house process data that can help management strategize better.

To simplify this, it is advisable to contain the adoption of technology within one department initially. This can help gauge responsiveness from both employees and management. From there on, the technology can then be adopted by others (property wide or company wide). Management, too, can better adapt the use of this app and observe staff responses. Once the platforms are in use, and then integrating them into existing systems to heighten usage and optimise processes amplifies seamless operations.

When fully functional, management can create reports to recognise their team skills and compare and correlate usage within the app to metrics such as employee satisfaction and retention, guest satisfaction and retention, printing costs, training costs and productivity levels, all of which will be demonstrated financially as well.

By working with developers to customise technology to best suit your property, it allows you to exploit every function for maximum efficiency. With all the technology available at our disposal, do not invest in technology without purpose; rather invest in technology that serves your staff to serve your guests better eventually.

Key Drivers for Hotel and Resort Spa Profitability

Relaxation and a sense of wellbeing are at the heart of the spa and wellness market. Hence, it’s no wonder that hotels, resorts, and spas have begun to reorganize their operations around wellness. The benefits, in the form of a stronger bottom line and appeal to demand segments, extend not only to guests but to hoteliers and hospitality companies, as well.

Traditional resort spas cater to relaxation through a variety of services including aesthetics, facials, and massage. Some also offer salon services for hair and nails. Wellness-focused resort spas cater to diet and nutrition, spiritual counseling, and naturopathic health- and prevention-oriented services that extend beyond the scope of a traditional spa.

This article looks at the scope of growth for traditional and wellness-focused spas worldwide, as well as the physical and operational keys to building stronger bottom-line performance.

Asset Attributes

Both traditional and wellness-focused spas are considered effective operating models that can add value to a guest’s hotel or resort destination experience. Moreover, they add value to the hospitality operation itself. These models have begun to merge, presenting a new subdivision of resort and hotel wellness-driven spa environments.

The nuances and specifications of these spas vary extensively, as each property has its own unique selling points, specialties, and demographic advantages. One thing hotel and resort wellness spas have in common is that they are at the epicenter of one of the fastest-growing spa and wellness market segments. They are also charted for tremendous rolling growth for their marketability and the increasing demand for experiential and leisure travel.

Coupled with new tactics for aiding prevention, increasing happiness, and relieving stress, this new spa “type” brings immediate benefits along with long-term opportunities for client engagement and retention. The Millennial generation and its relatively younger, health savvy members are a prime demographic for the wellness-oriented hotel and travel space. However, the Baby-Boomer market still comes in strong seeking longevity, anti-aging, and lifestyle services to improve overall quality of life.

Revenue

Traditional spas generate cash-based revenue for elected services. These services are priced based on treatment type, quality, duration of service, and packages. Additional revenue sources for spa services can include a daily fee for spa facility use and auxiliary services, such as poolside massage or treatment provisions provided in other areas of the hotel and guest spaces.

While spas are a cash revenue producer, wellness centers comprise a mix of cash, insurance, memberships, and payment plans. Diversifying spa modalities and treatment options can abundantly increase the scope of treatment revenue. This can be a unique advantage based on the goals of the property, client demand, and guest profiles. While luxury resort spa pricing can come at a premium, spa and wellness-center costs are equally competitive, making the move to diversify services more intriguing and ultimately more lucrative.

Owners and operators need to have a wide view of the potential revenue generators for a hotel or resort’s spa operation. This includes services, new modalities, and technology as well as retail sales. Whereas treatments and services are core to revenue performance, a well-performing retail segment can add meaningful value to a spa’s bottom line with an average continuum percentage between 10% and 35% of a spa’s annual revenue. Therefore, operators need to maximize efficiencies in the retail space to make it a high-acting outlet. This also requires sales talent and retail training that backs the process of creating higher product rotation and stronger retail sales growth.

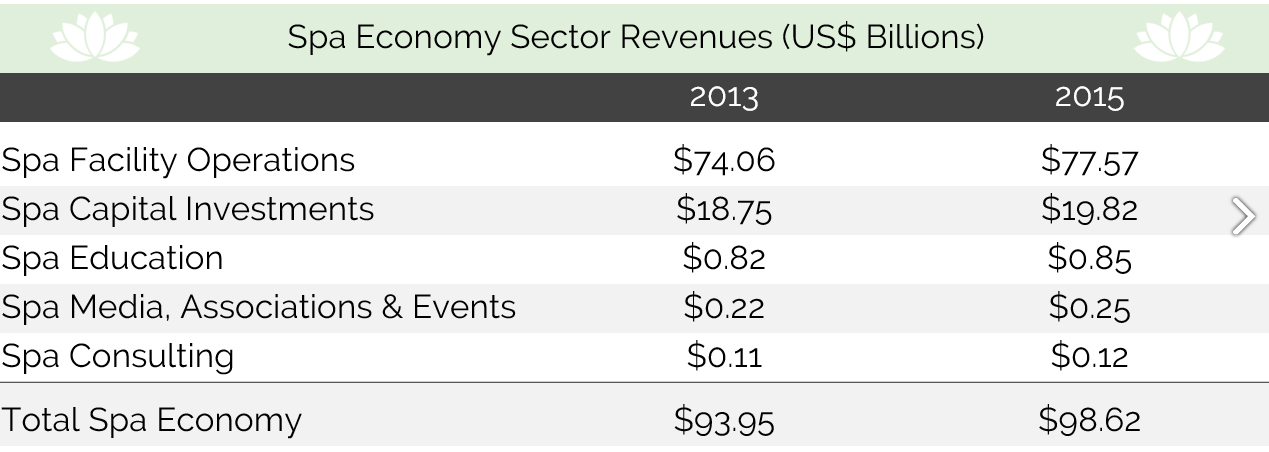

The following table charts the nearly $5 billion in overall growth of the global spa market between 2013 and 2015. As stated above, this growth has come in the form of new and innovative spa services, as well as product lines that appeal to a wide variety of wellness travelers, including corporate and leisure demand.

Global Market Growth

According to the Global Wellness Institute’s (GWI) 2017 Global Wellness Economy Monitor, the global spa market grew 2.3% between 2013 and 2015, resulting in a $98.6-billion market. Once considered an amenity (the pejorative term for what spas provide was “pampering”), spa facility revenues in 2015 were worth $77.6 billion globally, while revenue from supporting market sectors that enable spa businesses was reportedly worth $21 billion. These are big numbers, and they’re moving upwards.

Between 2013 and 2015 alone, the number of new spa locations increased worldwide from 105,591 to 121,595, adding more than 16,000 new spa facilities and over 230,000 individuals to its workforce. Spa segment growth is anticipated to flourish by an additional 6%, to be worth $103.9 billion by 2020.

The GWI study also reports that global wellness tourism revenues grew to $563 billion, a striking 14% rise from 2013 to 2015. The U.S., the #1 wellness market in the world, represented $202 billion of these revenues, nearly triple that of the #2 market. The GWI estimates that wellness tourism will grow another 37.5%, to $808 billion, by 2020.

Katherine Johnston, a GWI fellow and senior researcher, speaks of “a profound shift in the way people consume wellness.” She refers to the “infusion” of wellness—in the form of fitness, nutrition, stress reduction, prevention, and other modes—into people’s everyday life, as opposed to a luxury or indulgence taken on once or twice a year.

Today’s $3.72-trillion global wellness market presents new value propositions for hospitality and travel. “The spend on proactive healthy choices,” says Johnston, “will continue to comprise a greater percentage of massive multi-trillion-dollar industries, [including] real estate, food and beverage, [and] travel.”

There is a profound upward shift in spa and wellness throughout the hospitality market. Data back this forecast and growth, and these features are no longer the counterpart of temporary trends. This momentum is escalating and long-lasting, led by increasing consumer awareness and higher experiential expectations.

Investment Value

The force of the spa and wellness industry’s success in recent years has changed the way hoteliers approach the expanse of demand for spa and wellness offerings at their hotels and resorts. Hyatt’s recent acquisition of wellness pioneer the Miraval Group illustrates the enthusiasm behind spa and wellness investment in hospitality.

“Hyatt’s growth strategy includes a continued focus on growing wellness experiences and super serving the high-end traveler,” said Angee Smithee, Senior Director of Spas for Hyatt. “For several years, wellness has been a key area for the company as it strives to continue to better care for and understand our guests. Our recent acquisition of Miraval Group provides a proof point for Hyatt’s growth strategy, but more importantly, it is also a demonstration point around our core purpose of care. Hyatt is committed to increasing the lens through which we view our core customer desires,” said Smithee, “and clearly the $420-billion wellness tourism market is one where we are well positioned to capitalize on those opportunities.”

The increase in wellness-related travel (transient and group) is leading hospitality giants like Hyatt to pursue spa and wellness models as a wise value-add to hotels and resorts. Corporate wellness programs and executive meetings have also diversified the growth in leisure and wellness tourism.

New hotel developments, capital improvements, and spa and wellness program investments continue to rise in the global market. At the same time, there is powerful positioning bringing in stronger and swifter returns on investment. These investments and actions are driven by innovation and new technological options that back the design of substantial new program possibilities.

Profitability

A hotel spa that caters to wellness can provide a strong competitive advantage for the leisure and wellness-minded customer, as well as corporate groups. However, achieving an operational flow alongside profitability often presents a challenge, making it crucial to understand industry benchmarks that support this evolving market.

Some key factors to consider include the square footage of the spa and the allocated square footage for treatment rooms. It is also important to factor in the square footage of a property’s fitness area(s) and the space created for wet and dry amenities. These can include steam rooms, showers, dry saunas, hot tub and pool space, and the spa’s dedicated space for relaxation and retail.

In addition to square footage, there are multiple scenarios pertaining to auxiliary services, hotel occupancy rates, and a property’s unique selling points. Guestroom ratios based on seasonal or annual performance can represent upswings and dips in overall utilization. However, the ratios between internal and external marketing and promotions can also significantly sway the range and relationship of services between distinct departments. Done well, these assets can overlap, providing mutual support.

Labor costs also affect profitability. Hence, operators must manage staffing logistics, employee satisfaction, and anticipate turnover to achieve a well-tooled operational structure and the most profit from their spa operation. Understanding how to leverage new tools, such as automation and technology, can foster more efficiency, reduce costs, and substantially increase spa revenue.

Conclusion

Spas and wellness-oriented operations have had a meteoric rise over the past several years and continue to make waves in the lodging industry, particularly at resorts. Hyatt and other hospitality companies highlight the shift toward wellness operations. While traditional performance methodologies still apply, the complexities surrounding the proper implementation and execution of the spa and wellness components remain keys to maximizing the asset’s revenue potential.

Hospitality Financial Leadership – Separating Group and Local Sales in Banquets

If your hotel has a reasonable amount of meeting space (+10,000 ft) and your banquet business is a significant contributor in your Food and Beverage Department (+20% of F&B revenue), you are going to want to separate local banquet business from group banquet business on all of your financial statements, forecasts, budgets and daily reporting.

At this moment you may be asking, “Why would I want to do that? That sounds like a lot of work.” There are some very good reasons to make this practice a standard in your hotel. I see many hotel financial statements and most are missing the boat because they do not separate group and local banquet revenues. Separating this reporting and setting it up properly provides powerful information you can use in your hotel to make better decisions and ultimately be more profitable. When you take the process apart and look at each piece, it is not complicated. It just requires someone who wants to do it. That begs a question: “Why would I want to set up separate revenue reporting for groups and locals inside my banquet department?”

The first reason is to track the revenue and follow the profitability.

You want to know how much banquet revenue is generated by groups in-house who occupy your bedrooms vs the revenues generated by local customers who use your hotel’s meeting rooms and banquet facilities, but don’t occupy rooms.

We normally refer to the business coming from in-house groups as Conference Service. We call the business that comes from customers who do not occupy rooms as Catering and we also call them Group and Local.

If a significant portion of your F&B revenue comes from banquets, there is a very good chance that you have two competing elements inside this revenue stream. You want to know how much revenue comes from each separate element. In rare circumstances (like a remote resort without significant local business), this separation may not be necessary. All other hotels that have a good mix of business would benefit from reporting this data separately.

You want to know the revenue separation for all types of sales in the banquet department. The following areas need separate reporting: food, beverage, room rental, audio visual, gratuities and miscellaneous.

Groups vs. Local

You need to understand the spending characteristics of these two different customers so you can choose your customers wisely. If you are running a full-service banquet and meeting facility and, on top of it, you have a few hundred bedrooms to sell, you want to use the meeting and banquet facilities to drive room nights. When you do not have opportunities to fill your hotel with groups, you want to be able to sell your space to local customers who want to hold meetings and events without staying at your hotel.

Understanding the spending and profit potential that each different element produces will help you develop your strategy for selling to groups vs local business. What does the average customer spend in local catering vs in-house groups? What are your minimum food and beverage sales per room occupied for your in-house groups? What is the minimum amount spent on food and beverage to release the main ballroom or other anchor rooms in your hotel? An essential element to properly manage your hotel is understanding these characteristics and the corresponding seasonality. Separating the revenues is the only way to go.

When you review your financials, your budgets and forecasts you need to understand the makeup of the entire revenue picture in your hotel. Groups vs transient and corporate room revenue and local vs. in-house banquet business create a different picture each month, week and day in your hotel.

Understanding what it will take to drive the maximum revenues and profits starts with understanding the piece of business that is going to bring you the greatest contribution of both and what time of year. In most hotels with significant meeting space, it is group business; when these group opportunities are minimal, like summer, holidays and weekends, you want to sell your space to local catering customers. Therefore, you need separate financial revenue reporting within the banquet department to measure your effectiveness. If you lump it all together as many hotels do, you are missing a huge opportunity to better understand and manage your business.

The second reason is to organize your team: sales, conference services and catering so you can sell and service the business most effectively. This is where the water quite often gets murky.

Depending on how you organize your efforts in catering and conference services, you probably have people dedicated to one or the other or, in some cases, both group and local elements. In your sales department for rooms, you have sales managers with segments to sell into, quotas to meet, and bonuses to earn. These sales quotas must contain food and beverage spending minimums. This is a critical hook that many hotels waiver on with groups in certain “need periods.”

In conference services, you want to know how much revenue each seller and each group is generating. You want to have Intel so you can see the overall spending of each in-house group. You want to know how much revenue is produced by each catering manager. These leading indicators help you maximize your revenues and profits. If you do not know how much revenue each seller in the various areas is producing, how will you know how effective they are and what is possible.

Are you leaving money on the table by not having enough sellers in each area? Are the efforts of each seller today producing enough revenue to justify their positions? Are your F&B spending parameters effective and do they adjust seasonally to reflect your change in business mix? Do your catering minimums and room rental policies reflect the most up-to-date data? Most hotels cannot tell you these important statistics. The main reason is that they do not separate group and local business reporting.

On top of all of this is the 6,000-pound rhinoceros in any hotel that has significant group business mixed with local banquet demand. How and who controls the meeting space in your hotel? What tools do they have to help them decide when to release banquet space for local business and when to hold onto it to sell to groups?

Are you organized to make the best decisions for the hotel?

In most hotels, this is a hotly contested subject. Most hotels have some guidelines but when you dig into the policy for meeting space vs room nights, vs room revenue, vs banquet revenues, vs group spending, vs local spending ,vs the profitability for each element, you are not going to find much in the way of evidence to win your case. You will find a lot of opinions but not a lot of facts to back them up.

Having these spending and room night guidelines, by season, by day of the week, and by segment with an effective review process is the picture you want to build. By building this structure in your banquet department you will start to develop your revenue management muscles. The combined rooms and banquets, groups and local revenue management intelligence in your hotel is the result.

You need to create the system to separate these two revenue streams in your banquet department to see what is really going on; and it is not difficult. It begins with how you organize your selling and servicing of groups, their corresponding banquet event orders “BEO’s” and separate codes for group vs local. Next, it is a point of sale system “POS” that has separate revenue buckets for the group and local sales. These are easily set up. You need floor staff who are trained to “post” the banquet sales to the corresponding codes from the BEO’s. You need to review and ensure that all revenues are posted correctly.

Next, you need to set up daily reporting for the group and local sales on your daily flash reports. Your monthly financial statements and general ledger need to be programmed to have separate codes and reporting for the group and local sales inside the banquet department. Monthly forecasts and annual budgets that include analysis and reporting are also necessary.

Summing it all up.

Track and report your banquet group and local business separately. Do this on all your financial reports, daily, monthly and annually. Budget and forecast these revenue streams separately. Track and manage these revenue streams by the seller. These disciplines will lead you to full-blown revenue management processes that integrate rooms with banquets.

Understand your business better with the right data and you will make better selling decisions and increase your overall hotel profitability.

It is not complicated. What are you waiting for?

Dinah-Louise Marrs named General Manager of Swiss-Belhotel Brisbane

Swiss-Belhotel International has named industry veteran Dinah-Louise Marrs as General Manager for the launch of Swiss-Belhotel Brisbane. Mrs. Marrs brings a wealth of experience to the role having worked in key positions in the hospitality industry in Australia and Thailand over a distinguished 20-year career.

Mr. Gavin M. Faull, Swiss-Belhotel International Chairman and President, said Mrs. Marr and her team would ensure all pre-opening preparations were in place while achieving high operational and branding standards and the financial goals set by Swiss-Belhotel International.

“Dinah-Louise is the ideal person to steer the 4.5-star Swiss-Belhotel Brisbane when the leisure and business hotel opens on 15 October 2016 at this beautiful city’s vibrant South Bank precinct overlooking the Brisbane River,” Mr. Faull said. “This is a project hotel – our first in Brisbane – and we are very excited about expanding our footprint in Australia and imparting our unique brand of passion and professionalism in another key destination.”

Prior to joining Swiss-Belhotel, Mrs. Marrs was General Manager of The Point Brisbane Hotel for a decade. She also spent three years at Six Senses Hotels and Resorts in Thailand, first as a Reservations and Guest Relations Manager and then as a Strategic Planner and Operations Analyst.

Mrs. Marrs graduated from the prestigious US-based Cornell University School of Hotel Administration’s General Managers program in January 2016. She is an Associate Fellow of the Australian Institute of Management.

“It’s a huge honour to be entrusted with the role of launch General Manager for this property and to begin my relationship this way with such an esteemed group as Swiss-Belhotel International,” Mrs. Marrs said. “South Bank is Brisbane’s premier lifestyle and cultural destination, with South Bank Parklands boasting 17 hectares of key attractions such as world-class restaurants and cafés, parks, markets, the Wheel of Brisbane – a 60-metre ferries wheel – and a massive man-made beach. We couldn’t be situated in a better location.”

Swiss-Belhotel Brisbane is also located close to international sporting facilities, private hospitals, Brisbane Convention and Exhibition Centre, Queensland Maritime Museum, Griffith University and many more popular attractions and facilities.

The hotel offers 134 guest rooms and suites and other international-standard amenities include a pool, fitness center and conference facilities. Café 63, a very successful café and restaurant group in Brisbane, is subleasing a space at the hotel and will also provide room service as well as other F&B services.

The spacious, beautifully designed rooms and suites span levels one to seven. The room categories are Superior Rooms, Deluxe Studios, Executive Studios and Swiss-SuperSuites. There is also a residential component called Peak Apartments, located above the hotel comprising 46 spacious apartments and penthouses. Swiss-Belhotel Brisbane will also manage and service the apartments and their residents.

Source: http://ehotelier.com/news/2016/07/19/dinah-louise-marrs-named-general-manager-swiss-belhotel-brisbane/

The Secret to Asking Questions Correctly

My buddy Gary Chervitz just came back from Las Vegas, he was excited to share a customer service story with me and he prefaced it by saying it may not sound like a big deal, but after he told me what happened, I told him that while it may not be a big deal, it was still extremely important and worth sharing.

Gary was at a restaurant and almost finished with his meal. He had set his fork and knife down. The server noticed he had stopped eating, yet there was still a little food left on the plate. He asked Gary, “Are you continuing to enjoy your meal?” Gary acknowledge with a simple, “Yes,” and the server came back later, after Gary had obviously finished, and took his plate.

What impressed Gary was not that the server was polite and obviously very good at his job. It was the server’s question. The actual words he used, “Are you continuing to enjoy your meal?”

What made that question stand out was what happened after talking to Gary when I went to dinner with my wife. Toward the end of the meal the server came over and asked, “You still working on that?”

I never really thought about that question before – until that night. I replayed the conversation Gary and I had earlier that day. I contrasted the two servers’ questions.

I never really thought about that question before – until that night. I replayed the conversation Gary and I had earlier that day. I contrasted the two servers’ questions.

Both servers’ intentions were the same, to take care of us. It’s just the language they used. One was polite – even classy and sophisticated. The other, in comparison, was a little “raw.”

Again, I’d never thought much about this before. Servers have asked questions such as, “Can I take your plate?” or “Are you finished?” They are just doing their job. Even, “Are you done with that?” isn’t bad. Until you compare it to the classiness of, “Are you continuing to enjoy your meal?”

Let me share another example. I’m sure you’ve walked into a retail store and a salesperson came up to you and with a friendly smile, welcomed you and asked, “Can I help you?”

Compare that with what my friends at Ace Hardware train their people to say as a greeting. Again, with a friendly smile and warm greeting, the salesperson asks, “What can I help you find today?”

Totally different ways to ask the same question, even though you may get the same answer. Yet the customer experience is enhanced by the way the question is asked. In the restaurant, it is classier. In the retail store, it’s a friendlier open ended question.

The secret to having people ask the right questions – in the right way – is training. Create the right question, describe the scenario, even consider role playing the scenario, and then practice it. Training and reinforcement. That’s the key to getting the people to phrase questions, responses and statements the way they should be made.

It’s all in how you say it.

Source: http://www.4hoteliers.com/features/article/9507

Why Your Guests Won’t Tell You When They Have an Issue

Most people believe that as long as guests aren’t complaining, they must be satisfied, this isn’t, however, strictly true: Research shows that only one out of every 26 unhappy guests bothers to voice their concerns about their stay, and, moreover, that 91 percent of those who want to complain simply never come back.

This is an unfortunate situation for hotels, as research also shows it costs anywhere from five to 25 times more to acquire a new guest than it does to retain an existing one.

Another unsettling thought: just because they aren’t complaining to the hotel doesn’t mean they aren’t complaining elsewhere — to 10 or 15 of their friends, for example.

To figure out how to get these silent guests to communicate their concerns, hoteliers must first understand why guests choose not to bring their concerns forward. For the most part, complaining comes as easily to humans as breathing — and is shown, in fact, to have numerous health benefits — yet in customer service situations, people often choose to say nothing. There are several reasons for this.

It’s inconvenient, complicated, or just too much effort.

Sometimes it’s easier to just walk away (or write a scathing post on Twitter) than it is to go all the way down to the front desk, wait to speak to the clerk, then wait some more to speak to the manager, before finally — possibly — getting the issue resolved.

They also know other avenues can be equally troubling. If they call a customer service help line, they might have to contend with a never-ending phone tree, or get stuck on hold for a long period of time. In such cases, many will take the path of least resistance and merely choose not to say anything.

They’re too shy to speak up.

And then there are the guests who want to say something, but do not want to make a scene. Conflict is part of being human, but so is the avoidance of it; many guests will choose the most painless option for resolving their problem, and that resolution sometimes involves going to a competitor for service instead.

They don’t believe it will get them anywhere.

Many guests think their issue is so complex that a satisfying resolution can’t possibly be found. In some cases, they’ve probably been burned before. Imagine, for a moment, that you’ve booked a room at a hotel. When you arrive, you find that your room has a view of the parking lot and the air conditioner is broken. You go down to the desk to ask for a new room, but they tell you they’re fully booked and can do nothing for you, besides send up a repairman sometime in the next couple of hours.

Having faced such a scenario before, many guests may conclude that there is little point in bringing an issue up with the hotel.

They fear incurring the brand’s wrath.

Not all customer service representatives are equipped to provide guests with courteous service. When a guest has been treated with derision by management in the past, they sometimes worry that the incident will repeat itself at a new property. In such cases, they feel it is safer to say nothing than be treated harshly by staff, no matter how well-trained and professional your own staff may be.

Can you identify other reasons guests might choose not to voice their concerns? Let us know in the comments or on LinkedIn, Facebook, or Twitter — and keep an eye on our blog next week to learn how you can get your guests to come to you with their concerns.

“Optimization Treasures” Flow to Savvy Hotel Buyers

The ability to find measurable hidden value in a hotel, before acquisition, provides hotel buyers with foresight to confidently negotiate and recognize undetected long term benefits. The Optimization Scoring Metric, calculated in the due diligence phase of acquisition, uncovers treasures that could never be seen before.

The missing metric, in hotel industry analytics, is the Revenue Optimization Metric. “The Metric” allows prospective hotel buyers to identify unremarkable performance in revenue generation. The substitution of unremarkable with remarkable is the space in which value is created. The metric/score quantifies the shortfall and then projects potential profitability based on a typical scoring range (see Exhibit “C”, below).

What is the Optimization Metric?

The Optimization Metric provides hotels with an evaluation of the effects that (1) complete channel cost, (2) channel mix and (3) the merchant model, have on profit and cash deposits (I refer to these as the “critical factors”).

The calculations involved in determining the Optimization Score place all reservation-vendors on an equal platform in measuring production and removes the flawed inaccuracies created by the Merchant Model. Needless to say, in a data driven society flawed metrics present big problems. These flaws, are present in the traditional calculation of hotel metrics. Follow the link, in the paragraph below, for more on “the optimization metric and flawed industry metrics”.

Source: http://www.hospitalitynet.org/news/global/154000320/4074633.html

RobertDouglas Advises on the $60,000,000 Sale of the Wyndham Garden Manhattan Chelsea West in New York, NY

RobertDouglas announced today that it advised Gemini 37 West 24th Street MT, LLC, a subsidiary of Gemini Real Estate Advisors, in the sale of the Wyndham Garden Manhattan Chelsea West. The sale was arranged pursuant to a Chapter 11 proceeding and closed on Feb. 29, 2016. The 124 key hotel, located steps from Madison Square Park in the heart of the dynamic Flatiron District, was purchased by Fortuna Realty Group, LLC for $60,000,000, or approximately $485,000 per key, following a lively auction administered by the U.S. Bankruptcy Court for the Southern District of New York.

RobertDouglas announced today that it advised Gemini 37 West 24th Street MT, LLC, a subsidiary of Gemini Real Estate Advisors, in the sale of the Wyndham Garden Manhattan Chelsea West. The sale was arranged pursuant to a Chapter 11 proceeding and closed on Feb. 29, 2016. The 124 key hotel, located steps from Madison Square Park in the heart of the dynamic Flatiron District, was purchased by Fortuna Realty Group, LLC for $60,000,000, or approximately $485,000 per key, following a lively auction administered by the U.S. Bankruptcy Court for the Southern District of New York.

“This sale creates an opportunity for Fortuna to add to its already impressive portfolio of lifestyle hotels,” said Evan Hurd, Senior Director at RobertDouglas. “The property’s high quality facilities and ideal location at the heart of New York’s technology and media scene make it well positioned to take advantage of the ongoing growth of the Midtown South submarket.”

“The transaction was completed after a complex bankruptcy process at an attractive purchase price, and is an excellent outcome for our investors,” said Dante Massaro, president of Gemini Real Estate Advisors. “We are excited to see a group with a long-term stake in this neighborhood execute its vision for this quality property. This is the third closing and brings us one step closer to completing the sale of the four properties from the Chapter 11 proceeding.”

“This deal speaks to the resiliency of the market for high quality lodging assets in New York City,” commented David Smith, a Senior Associate at RobertDouglas. “The final purchase price of over $480,000 per key represents a significant premium to the stalking horse bid, creating a favorable outcome for our client and underscoring the confidence that long-term investors have in this one-of-a-kind market.”

Source: http://www.hospitalitynet.org/news/global/154000320/4074660.html