Economy News

Economy News

The COVID-19 travel shock hit tourism-dependent economies hard

The COVID crisis has led to a collapse in international travel. According to the World Tourism Organization, international tourist arrivals declined globally by 73 percent in 2020, with 1 billion fewer travelers compared to 2019, putting in jeopardy between 100 and 120 million direct tourism jobs. This has led to massive losses in international revenues for tourism-dependent economies: specifically, a collapse in exports of travel services (money spent by nonresident visitors in a country) and a decline in exports of transport services (such as airline revenues from tickets sold to nonresidents).

This “travel shock” is continuing in 2021, as restrictions to international travel persist—tourist arrivals for January-May 2021 are down a further 65 percent from the same period in 2020, and there is substantial uncertainty on the nature and timing of a tourism recovery.

We study the economic impact of the international travel shock during 2020, particularly the severity of the hit to countries very dependent on tourism. Our main result is that on a cross-country basis, the share of tourism activities in GDP is the single most important predictor of the growth shortfall in 2020 triggered by the COVID-19 crisis (relative to pre-pandemic IMF forecasts), even when compared to measures of the severity of the pandemic. For instance, Grenada and Macao had very few recorded COVID cases in relation to their population size and no COVID-related deaths in 2020—yet their GDP contracted by 13 percent and 56 percent, respectively.

International tourism destinations and tourism sources

Countries that rely heavily on tourism, and in particular international travelers, tend to be small, have GDP per capita in the middle-income and high-income range, and are preponderately net debtors. Many are small island economies—Jamaica and St. Lucia in the Caribbean, Cyprus and Malta in the Mediterranean, the Maldives and Seychelles in the Indian Ocean, or Fiji and Samoa in the Pacific. Prior to the COVID pandemic, median annual net revenues from international tourism (spending by foreign tourists in the country minus tourism spending by domestic residents overseas) in these island economies were about one quarter of GDP, with peaks around 50 percent of GDP, such as Aruba and the Maldives.

But there are larger economies heavily reliant on international tourism. For instance, in Croatia average net international tourism revenues from 2015-2019 exceeded 15 percent of GDP, 8 percent in the Dominican Republic and Thailand, 7 percent in Greece, and 5 percent in Portugal. The most extreme example is Macao, where net revenues from international travel and tourism were around 68 percent of GDP during 2015-19. Even in dollar terms, Macao’s net revenues from tourism were the fourth highest in the world, after the U.S., Spain, and Thailand.

In contrast, for countries that are net importers of travel and tourism services—that is, countries whose residents travel widely abroad relative to foreign travelers visiting the country—the importance of such spending is generally much smaller as a share of GDP. In absolute terms, the largest importer of travel services is China (over $200 billion, or 1.7 percent of GDP on average during 2015-19), followed by Germany and Russia. The GDP impact for these economies of a sharp reduction in tourism outlays overseas is hence relatively contained, but it can have very large implications on the smaller economies their tourists travel to—a prime example being Macao for Chinese travelers.

How did tourism-dependent economies cope with the disappearance of a large share of their international revenues in 2020? They were forced to borrow more from abroad (technically, their current account deficit widened, or their surplus shrank), but also reduced net international spending in other categories. Imports of goods declined (reflecting both a contraction in domestic demand and a decline in tourism inputs such as imported food and energy) and payments to foreign creditors were lower, reflecting the decline in returns for foreign-owned hotel infrastructure.

The growth shock

We then examine whether countries more dependent on tourism suffered a bigger shock to economic activity in 2020 than other countries, measuring this shock as the difference between growth outcomes in 2020 and IMF growth forecasts as of January 2020, just prior to the pandemic. Our measure of the overall importance of tourism is the share of GDP accounted for by tourism-related activity over the 5 years preceding the pandemic, assembled by the World Travel and Tourism Council and disseminated by the World Bank. This measure takes into account the importance of domestic tourism as well as international tourism.

Among the 40 countries with the largest share of tourism in GDP, the median size of growth shortfall compared to pre-COVID projections was around 11 percent, as against 6 percent for countries less dependent on tourism. For instance, in the tourism-dependent group, Greece, which was expected to grow by 2.3 percent in 2020, shrunk by over 8 percent, while in the other group, Germany, which was expected to grow by around 1 percent, shrunk by 4.8 percent. The scatter plot of Figure 2 provides more striking visual evidence of a negative correlation (-0.72) between tourism dependence and the growth shock in 2020.

Of course, many other factors may have affected differences in performance across economies—for instance, the intensity of the pandemic as well as the stringency of the associated lockdowns. We therefore build a simple statistical model that relates the “growth shock” in 2020 to these factors alongside our tourism variable, and also takes into account other potentially relevant country characteristics, such as the level of development, the composition of output, and country size. The message: the dependence on tourism is a key explanatory variable of the growth shock in 2020. For instance, the analysis suggests that going from the share of tourism in GDP of Canada (around 6 percent) to the one of Mexico (around 16 percent) would reduce growth in 2020 by around 2.5 percentage points. If we instead go from the tourism share of Canada to the one of Jamaica (where the share of tourism in GDP approaches one third), growth would be lower by over 6 percentage points.

Measures of the severity of the pandemic, the intensity of lockdowns, the level of development, and the sectoral composition of GDP (value added accounted for by manufacturing and agriculture) also matter, but quantitatively less so than tourism. And results are not driven by very small economies; tourism is still a key explanatory variable of the 2020 growth shock even if we restrict our sample to large economies. Among tourism-dependent economies, we also find evidence that those relying more heavily on international tourism experienced a more severe hit to economic activity when compared to those relying more on domestic tourism.

Given data availability at the time of writing, the evidence we provided is limited to 2020. The outlook for international tourism in 2021, if anything, is worse, though with increasing vaccine coverage the tide could turn next year. The crisis poses particularly daunting challenges to smaller tourist destinations, given limited possibilities for diversification. In many cases, particularly among emerging and developing economies, these challenges are compounded by high starting levels of domestic and external indebtedness, which can limit the space for an aggressive fiscal response. Helping these countries cope with the challenges posed by the pandemic and restoring viable public and external finances will require support from the international community.

Source: https://www.brookings.edu/research/the-covid-19-travel-shock-hit-tourism-dependent-economies-hard/

Tourism officials warn new restrictions on air travel will cripple industry

Seeking to curb the Delta variant Israel adds 18 countries, including the US, to its COVID-19 travel warning list. Tourism industry official: This is collective punishment over the government’s failure to enforce other restrictions.

Tourism industry officials warned Tuesday that the government’s decision to add a host of popular travel destinations to the list of COVID-19 watch would cripple the sector, which has barely begun recovering from being virtually paralyzed during the height of the global pandemic, which saw most countries close their skies and ban all nonessential air travel.

In its effort to stop the spread of the Delta variant, Israel’s so-called coronavirus cabinet added 18 countries to its travel warning list.

The move means that all those returning from these countries, including vaccinated individuals, will be required to quarantine for a minimum of seven days, pending two negative COVID-19 tests.

The newly added countries are Ukraine, Italy, Iceland, Eswatini (formerly Swaziland), the United States, Botswana, Bulgaria, Germany, Netherlands, Tanzania, Greece, Malawi, Egypt, Czech Republic, France, Cuba, Rwanda, and Tunisia.

The Knesset’s Labor, Welfare and Health Committee approved the list on the recommendation by the Health Ministry.

The measure was originally supposed to go into effect on Friday but was postponed until Wednesday, August 11.

The 18 new travel destinations join a host of previously flagged countries, including the United Arab Emirates, Guatemala, Honduras, Zimbabwe, Mongolia, Myanmar, Namibia, Fiji, Colombia, and Cambodia.

The Health Ministry has approved removing Uganda, Seychelles, Zambia, Liberia, Panama, Paraguay, Costa Rica, and Kenya from the list of high-risk travel destinations as of Friday.

Currently, the list of countries to which Israelis are barred from traveling altogether over their morbidity rates includes Argentina, Belarus, Brazil, Cyprus, Georgia, India, Kyrgyzstan, Mexico, Russia, Spain, South Africa, Turkey, United Kingdom, and Uzbekistan.

Traveling to these countries requires the permission of the government’s Exceptions Committee. Traveling to these destinations sans said approval carries a fine of 5,000 shekels ($1,500).

Senior tourism industry officials leveled harsh criticism at the government over the decision, telling Israel Hayom that it was akin to “collective punishment” over the government’s failure to enforce other restrictions placed on public life.

“We weren’t even told this [additional air travel restrictions] was up for discussion. Everything happened within two to three hours and they [the ministers] just made this decision under everyone’s noses,” one official said.

Calling the decision “delusional,” he further warns it would trigger mass layoffs.

“The problem isn’t with people flying, the problem is that the Health Ministry doesn’t know how to deal with people who violate quarantine and outline an orderly policy, so they punish everyone. Why were there no representatives of the [tourism] industry in this meeting? Something is happening here in contrast to what is happening in most other Western countries.”

Eshet Tours CEO Ephraim Kramer also panned the decision saying it spells “the de-facto shuttering of Ben-Gurion International Airport.”

He, too, criticized the fact that the Health Ministry had not made the criteria by which countries are flagged as high-risk COVID destinations public, saying, “Where’s the transparency vis-à-vis the industry and the public? What was the basis to bar travel to Germany and Bulgaria, where morbidity is lower than in Israel?

“The government is undermining its own interests by infringing on Israeli’s freedom of movement as well as the freedom of occupation of travel agents.”

Nir Mazor, vice president of Aviation Links, said that “expanding the list of countries that require quarantine even for vaccinated individuals deals another blow to the Israeli aviation and tourism industries.

“It is precisely against the backdrop of the important discussion about [health] awareness and the importance of motivating young people to get vaccinated, they [the government] chose to eliminate one of the main benefits stated at the beginning of the vaccination campaign – being exempt from quarantine.

“This decision is in stark contrast to the global trend of tourism opening again,” he explained. “The Western world, the United States, Britain, and Europe are currently maintaining air travel routines that are very close to pre-corona numbers, with an emphasis on free movement for vaccinated individuals, while the ‘world’s most-vaccinated country’ does the opposite.

“At the very least, the state must create an assistance mechanism for the companies and the thousands of workers who are again left behind without any lifeline,” he said.

Source: https://www.israelhayom.com/2021/08/04/tourism-officials-warn-new-restriction-on-air-travel-cripple-industry/

Economies reliant on tourism face second Covid summer slump

Pandemic’s spread and vaccine shortage deal blow to already-fragile growth prospects.

Tourism-dependent emerging economies that were already struggling before the pandemic with stretched finances and ballooning debt are counting the cost of their second successive summer season slump as the spread of coronavirus keeps visitors away. In the first five months of this year global international arrivals were on average 85 per cent down on the pre-pandemic total of 540m in 2019, according to data released in July by the UN’s World Tourism Organization. That is even worse than the same period last year, when arrivals were on average 65 per cent down year on year. Asia-Pacific was particularly badly hit, with a 95 per cent fall in arrivals compared with 2019 levels — due largely to the continuing absence of Chinese travellers. By contrast the return of US tourists has eased the hit to the Caribbean. We don’t see a significant recovery in foreign tourism for emerging markets this year Luiz Eduardo Peixoto, BNP Paribas The slump in tourism revenues across much of the emerging world comes as governments’ debts mount as they struggle to meet the costs of the pandemic. Average government debt in large emerging economies rose from 52.2 per cent of gross domestic product to 60.5 per cent in 2020, according to the Institute of International Finance — the biggest surge on record. The damage has not been evenly spread. Some economies entered the pandemic in better shape than others and are better able to weather the storm. IMF chief economist Gita Gopinath warned earlier this year that economic performance was “diverging dangerously across and within countries, as economies with slower vaccine rollout, more limited policy support and more reliance on tourism do less well”. The countries most as risk, said David Rogovic, senior analyst at Moody’s Investors Service in New York, were “the smaller, less diversified economies that entered the pandemic with weak fiscal conditions. Places like the Bahamas, the Maldives and Fiji are incredibly reliant on tourism and have seen a significant shock.”

Luiz Eduardo Peixoto, emerging markets economist at BNP Paribas in London, said that so far this year had been worse than predicted last year. “Last year, there was an assumption that in 2021 we would see a rebound,” he said. “But the drop [in numbers] last year was close to the most pessimistic scenario [forecast] by the UNWTO because we didn’t get a recovery during the [northern hemisphere] winter — quite the contrary. This year, things are not recovering as expected.” He cited as causes the slow pace of vaccine rollouts in many developing countries and the spread of new variants of the virus, which have stymied countries’ plans to ease border restrictions. For example, China has kept tight limits on inward and outward travel since the start of the pandemic, depriving destinations in south-east Asia of their biggest source of visitors.

Thailand generated 20 per cent of GDP and employment from tourism in 2019, according to Moody’s. Its attempts to open tourism bubbles for vaccinated visitors this summer have had a bumpy start, with visitors testing positive for the virus despite entry controls. However, the collapse of tourism has not tipped its public finances into crisis, Moody’s noted. This is because the strength of other areas of the economy such as manufacturing and other parts of the services sector have offset the shock to tourism. Other well-diversified Asian economies such as the Philippines and Cambodia are in a similar position. But diversification is less of an option for small island economies, especially where the fall in tourism receipts has exacerbated pre-existing problems. The Bahamas, whose credit rating had already been downgraded several times in the past decade because of its growing debt burden, is one such place. When the pandemic struck Moody’s downgraded it again in June last year, by two notches, and kept it on negative outlook for a possible further downgrade. Fiji and the Maldives face similar challenges because of rising debts and the difficulty of refinancing them among a limited range of international lenders, Moody’s has warned. The one bright spark is local tourism is that countries with a sizeable middle class are benefiting from holidaymakers choosing to stay at home this year. Peixoto at BNP notes that scheduled airline capacity for the third quarter of this year in Russia and China is greater than it was in the same period of 2019, thanks to a sharp rise in domestic travel. Countries such as Brazil, the Philippines, Argentina and Mexico are also benefiting. “We saw this for a couple of quarters last year, that Brazilian people who would usually go abroad were staying in the country and generating more income at home,” he said. “In Russia, it is contributing to inflationary pressures.”

This may not replace foreign currency earnings for such countries, he added, but it does keep hotels and other businesses open and workers employed. The UNWTO data show a hint of recovery in May, when international arrivals ticked up to 82 per cent below their pre-pandemic level, from being 86 per cent down in April. Most of the recovery is in advanced economies, however, leaving little positive news for tourism-dependent countries in the developing world. The sector’s reopening in the worst-affected regions is indefinitely on hold. “For them, it will be difficult to make a case for significant reductions in travel restriction this year,” said Peixoto. And as a result, “we don’t see a significant recovery in foreign tourism for emerging markets this year”.

Source: https://www.ft.com/content/ab4ad418-ad6f-4dae-a1b1-b7d05369eb3b

Tourism takes action on plastic waste and pollution

Addressing plastic pollution is essential to sustainably restart tourism, preserve destinations and contribute to climate action.

Tourism businesses and destinations are stepping up their commitment to sustainability. Aimed at reducing waste and pollution across the sector, the Global Tourism Plastics Initiative (GTPI) is welcoming 32 new signatories, with every global region represented behind the shared goal.

The Initiative unites the tourism sector behind a common vision to address the root causes of plastic pollution. It enables businesses, governments and other tourism stakeholders to lead by example in the shift towards a circular economy of plastics. Among the 32 new signatories are organizations such as TUI Group, AC Hotels by Marriott, Palladium Hotel Group, Sustainable Hospitality Alliance, Hostelling International, Thompson Okanagan Tourism Association and Visit Valencia. These new additions bring the total number of signatories up to 93 companies and organizations. These include organizations from stages of the tourism value chain, including accommodation providers, tour operators, online platforms, suppliers, waste managers and supporting organizations.

Andreas Vermöhlen, Manager for Sustainability, Circular Economy and Sustainable Development at TUI Group said: “Together we can make important steps towards less unnecessary single-use plastic in the world and shift towards a circular economy.”

Addressing plastic pollution is essential to sustainably restart tourism, preserve destinations and contribute to climate action

To mark the confirmation of the new signatories, UNWTO and the United Nations Environment Programme, in collaboration with the Ellen MacArthur Foundation, held a special panel discussion with the theme Eliminate. Innovate. Circulate. Strategies from the Global Tourism Plastics Initiative. Participants included Accor Group, The Hongkong and Shanghai Hotels, Palladium Hotel Group, Chumbe Island Coral Park and the Sustainable Hospitality Alliance.

Zurab Pololikashvili, UNWTO Secretary-General said: “Addressing plastic pollution is essential to sustainably restart tourism, preserve destinations and contribute to climate action. We are proud to see the number of signatories growing continuously since the launch of the initiative.”

Alongside this, a keynote presentation on “A Life Cycle Approach – Key messages for tourism businesses” further highlighted the aims of the GTPI, with a special focus on innovation and the importance of context-based approaches to ensure plastics are circulated back into the economy rather than thrown away after use.

Source: https://www.traveldailynews.com/post/tourism-takes-action-on-plastic-waste-and-pollution

France fines Google €1.1 million for ‘misleading’ consumers with its hotel rankings

France has fined Google €1.1 million for allegedly “misleading” consumers with their rankings of hotels and other tourist accommodations.

A 2019 investigation by the French consumer watchdog and finance ministry found the tech giant was guilty of “misleading commercial practice”.

Google Ireland and Google France have agreed to pay the fine as part of a settlement, after approval from the Paris public prosecutor, the ministry said.

Both organisations have since altered their practices, it added in a statement.

France’s Directorate-General for Competition, Consumer Affairs and Fraud Control (DGCCRF) had launched a probe into Google in September 2019 after complaints from hotels.

Businesses had argued that the display of around 7,500 hotels on Google’s search engine was unfair, compared to the official classification issued by Atout France, the country’s Tourism Development Agency.

The watchdog found that Google had replaced the Atout France ranking with their own criteria, but had used an identical system of 1 to 5 “stars”, which was “highly confusing” for customers.

“This practice was particularly damaging for consumers, who were misled about the level of service they could expect when booking accommodation,” the authority stated.

“It was also detrimental to hoteliers whose establishments were wrongly presented as being lower than in the official Atout France classification.”

Since September 2019, Google has “corrected their practices” and reverted to the official classification issued by Atout France.

“We have now settled with the DGCCRF and made the necessary changes to only reflect the official French star rating for hotels on Google Maps and Search,” a company spokesperson told Euronews.

Google stated that their previous classification of hotels used a variety of sources, including Atout France, as well as feedback from hoteliers and other party sources.

The settlement with the DGCCRF does not affect users’ ability to rate and review hotels on Google.

In December, Google was also fined €35 million by France’s online data privacy watchdog for allegedly breaching rules on cookies.

The National Commission for Informatics and Liberties (CNIL) said both Google and Amazon had automatically placed advertising trackers on users’ computers without asking for consent.

Source: https://www.euronews.com/2021/02/15/france-fines-google-1-1-million-for-misleading-consumers-with-its-hotel-rankings

Tourist Numbers Down 83% but Confidence Slowly Rising

International tourist arrivals were down 83% in the first quarter of 2021 as widespread travel restrictions remained in place. However, the UNWTO Confidence Index shows signs of a slow uptick in confidence.

Between January and March 2021 destinations around the world welcomed 180 million fewer international arrivals compared to the first quarter of last year. Asia and the Pacific continued to suffer the lowest levels of activity with a 94% drop in international arrivals over the three-month period. Europe recorded the second largest decline with -83%, followed by Africa (-81%), the Middle East (-78%) and the Americas (-71%). This all follows on from the 73% fall in worldwide international tourist arrivals recorded in 2020, making it the worst year on record for the sector.

Lack of coordination harms #RestartTourism

UNWTO Secretary-General Zurab Pololikashvili comments: “There is significant pent-up demand and we see confidence slowly returning. Vaccinations will be key for recovery, but we must improve coordination and communication while making testing easier and more affordable if we want to see a rebound for the summer season in the northern hemisphere.”

Vaccinations will be key for recovery, but we must improve coordination and communication while making testing easier and more affordable if we want to see a rebound for the summer season in the northern hemisphere.

The latest survey of the UNWTO Panel of Tourism Experts shows prospects for the May-August period improving slightly. Alongside this, the pace of the vaccination rollout in some key source markets as well as policies to restart tourism safely, most notably the EU Digital Green Certificate, have boosted hopes for a rebound in some of these markets.

Overall, 60% expect a rebound in international tourism only in 2022, up from 50% in the January 2021 survey. The remaining 40% see a potential rebound in 2021, though this is down slightly from the percentage in January. Nearly half of the experts do not see a return to 2019 international tourism levels before 2024 or later, while the percentage of respondents indicating a return to pre-pandemic levels in 2023 has somewhat decreased (37%), when compared to the January survey.

Tourism experts point to the continued imposition of travel restrictions and the lack of coordination in travel and health protocols as the main obstacle to the sector’s rebound.

The Impact of COVID on Tourism cuts global exports by 4%

The UNWTO World Tourism Barometer also shows the economic toll of the pandemic. International tourism receipts in 2020 declined by 64% in real terms (local currencies, constant prices), equivalent to a drop of over US$ 900 billion, cutting the overall worldwide exports value by over 4% in 2020. The total loss in export revenues from international tourism (including passenger transport) amounts to nearly US$ 1.1 trillion. Asia and the Pacific (-70% in real terms) and the Middle East (-69%) saw the largest drops in receipts.

Source: https://www.unwto.org/news/tourist-numbers-down-83-but-confidence-slowly-rising

Redefine Your Revenue Management Strategy

‘We started the year in 2020 and ended it in 2030’

Advertorial by Kevin Duncan, Senior Director, Strategic Commercial Initiatives at The Rainmaker Group, a Cendyn company

This quote from Inspired Capital co-founder Alexa von Tobel perfectly encapsulates the realities of the hospitality industry today. Trends have accelerated and we seem to have jumped ahead a decade, with transformative change happening seemingly overnight.

So, what is next for revenue management? We have an exciting opportunity to hit the reset button and rethink systems while demand is constrained. As we look ahead to the post-pandemic landscape, now is the time to build a revenue management discipline that maximizes revenue during both good times and bad.

Data delivers forever

As data-driven marketers and revenue managers, we have long been converts to the power of data. That’s not to undervalue professional instinct; it’s just that data, when collected accurately and interpreted correctly, does not lie. Data is necessary to determine performance and provide both comparative and key metrics that help decision-making.

This year, the complexities of COVID have leveled the playing field. We are all starting with a blank slate – and not just as historical data is concerned. We are navigating a whole new world, which requires a clear data-driven approach that mines every piece of data held by your organization for relevant insights. Travelers processes and ways of doing business have changed. What travelers deem important for travel today, may not be what it was pre-COVID, therefore the data that marketers and revenue management once considered valuable, may not be as useful as it once was.

One thing is for certain: those that analyze their data the most effectively – and act the most decisively – will be ahead of the rest.

Data-driven creativity is the secret sauce

Data is not necessarily the savior, and in some instances, data has even taken a backseat to creativity. Understanding the right data and utilizing it along with balancing creativity in marketing, will provide hoteliers the edge to perform at their greatest potential.

There is a need to relentlessly experiment and try new things. Conducting A/B testing and becoming a master at it is a must-have skill for revenue managers. Offers that may have performed well in the past, may not provide the same performance today. Therefore, put it all on the table – offers, promotions, segmentation, ancillaries, upsells, packages, room types, amenities – conduct experiments and evaluate the results. Today, it is really all about the survival of the most creative!

Micro-trends: future of forecasting

While it may be true that forecasting is forever changed – after all, you can’t always rely on long-term historical data to predict future performance – it is still incredibly useful. You just have to be faster! Rapid forecasting adjusts in real-time to microtrends, such as new pockets of demand.

Within your forecasting, it is important to keep a keen eye on projections at both the property and market levels. As we have experienced the global impact of COVID and how it influences travel patterns, you will want to have broader insight of global demand patterns in perspective as well.

As the situation is constantly evolving, you will need a system or the ability to re-forecast and adjust to shifting demand and bright spots quickly. Constant calibration of your revenue management system is necessary to quickly identify change and capitalize on new segments of demand.

Micro-trends: new rules of segmentation

Simple segmentation no longer works because demand has shifted so much. You must go micro: narrow in on the microtrends and microsegments that are the bright spots of demand.

Matching ancillaries, upsells and bundles to each segment opens the door of possibilities. When such level of granularity exists, you will be able to more easily identify microsegments and channels that can drive revenue. There is also the opportunity to leverage AI/machine learning to further segment your audiences automatically and intelligently.

Convergence reigns

The other major trend accelerated by COVID is the convergence of sales, distribution, marketing, and revenue management functions. This was already happening before the pandemic but the dramatic drop in business has eliminated positions and put more emphasis on doing more with less.

Time is a commodity for all. If strategy teams are spending extensive time gathering and merging data, they are missing the opportunity to analyze and be strategic. Automated revenue management tools can handle the data crunching so that you can better allocate your time and work on the soft skills that strengthen your teams: collaboration, communication, creativity.

Data-driven revenue management requires both the right data inputs and the right tools to analyze and act on that data. The revenue manager of 2021 will need to be an adaptable systems manager and a clever analytical thinker willing to take calculated risks. By fully harnessing the power of creativity and convergence, hotels will be able to compete in a year of unknowns. Revenue managers will need to move fast, stay flexible, be nimble, and lean into both automation and creativity.

How Does the Cruise Industry Begin to Attract New Customers?

When cruising does restart, die-hard fans will be first in line to board. But – for an industry that has long depended on new customers to fuel its growth – will those who have never cruised before be willing to embark?

Or will months of headlines about quarantines, positive onboard tests, and sensationalism about “floating petri dishes” scare off newbies?

Michelle Fee, CEO and founder of Cruise Planners, an American Express Travel Representative, said first-timers won’t be the primary focus when cruising initially resumes.

“With the early signs of pent-up demand, and the fact that most ships will be sailing at a reduced capacity, first-time cruisers are not going to be the focal point – the obvious choice will be past passengers,” Fee said. “They know how safe it is to travel on a ship and will have the confidence to board, fully knowing that the cruise lines have taken extraordinary precautions. I will say, our 2021-2022 cruise business has a solid foundation, so it doesn’t look like we’re going to have a hard time filling ships again, once this pandemic is behind us.”

First-timers will start booking again once life returns to normal, she predicted.

“Once things settle down, and finally get back to more normal, a first-time cruiser will be just as attracted, if not more, than they were before,” Fee wrote in an email. “With all the new protocols and changes, ships will be even more attractive than even before the pandemic. From seamless embarkations, new crowd-less muster drills, sanitation at its highest and more – the rumours, myths and negative perceptions will all be proven wrong and go away.”

“Travel advisors will need to focus on inspirational marketing along with presenting the health and safety protocols that the cruise industry is rolling out,” said Drew Daly, senior vice president and general manager of Dream Vacations, CruiseOne and Cruises Inc. “Advisors should become experts in the measures being taken as all consumers want to be informed as to what protocols are being implemented in all aspects of the vacation experience – including flights, pre- and post-cruise hotels, tours and onboard.”

Fee and Daly also said relaxed cancellation policies will reassure new-to-cruise clients.

“Yes, this has definitely helped our advisors close sales, so as long as there is the fear of contracting the virus, vacation companies should extend their flexible cancellation policies,” Fee said.

Daly agrees: “I do think more flexible cancellation policies will allow consumers the peace of mind they need when planning their cruise vacations in the short and long term.”

Both said a campaign, perhaps led by the Cruise Lines International Association (CLIA), is necessary to spread the word about safety measures.

“The industry absolutely has some damage control to do and needs to get the good word out about the stringent protocols the cruise lines will be following to keep cruising as safe as possible. We have been publicly speaking out and advocating for the CDC to back off of the cruise industry as it is negatively impacting consumer confidence in cruising and travelling in general,” Fee said. “Cruise Planners’ loyal customer base is already driving future travel sales. To reach new-to-cruise, we need the public perception to be safe to help our beloved industry to fully recover and rebuild. At Cruise Planners, we have not stopped our proactive marketing efforts, but have pivoted to a more supportive, educational and informative approach. One thing that has been wildly successful is our new Where2Next virtual series” for travel advisors’ clients.

Concluded Daly: “Yes, the safety and health protocols that will be implemented definitely need to be promoted heavily to consumers. Cruise lines, CLIA and travel agencies all need to collectively be talking about the measures and sharing what it looks like onboard. Consumers will want to see what life is like onboard and envision how their experience will unfold.”

Source: https://www.travelpulse.com/news/cruise/how-does-the-cruise-industry-begin-to-attract-new-customers.html

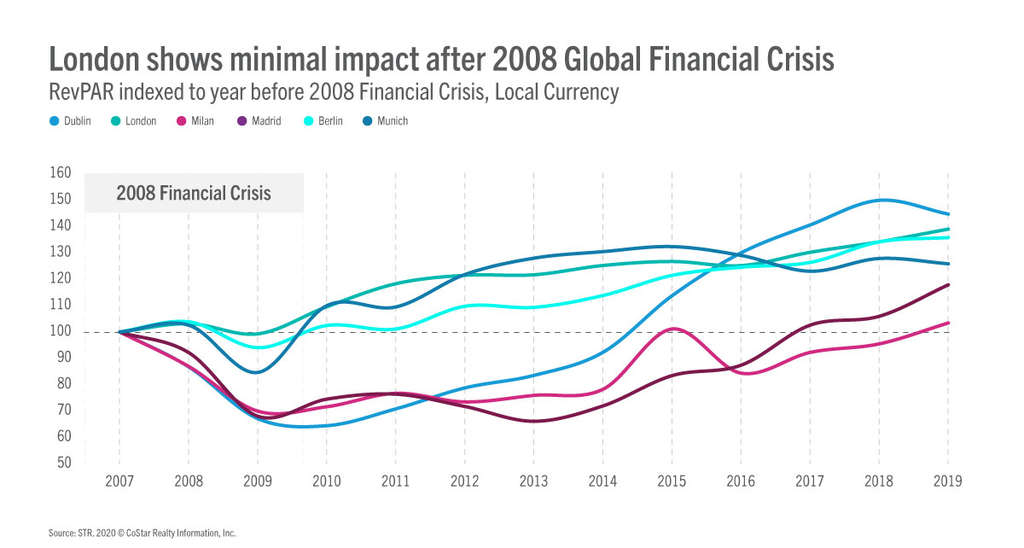

Europe’s Recovery From the Last Recession

Major economies in Europe, including the U.K. and those in the Eurozone, recently confirmed what we already suspected. Economies across the continent have entered an economic recession because of the impact of COVID-19—an impact that has been devastating for the hospitality industry.

The short-term effects of the COVID-19 recession are evident as hotel demand across Europe was down 55.3% for the August year-to-date period. However, even with negative projections in place, the depth of the long-term impact remains in question.

To help develop answers, we look back at a lesser crisis, which may point to how hotel markets will recover in the coming years. The 2007-08 global financial crisis (GFC), caused by the bursting of the U.S. housing bubble, impacted financial institutions globally and led to the subprime mortgage crisis, European debt crisis and the Great Recession. During the Great Recession, the global economy witnessed its steepest declines since the Great Depression.

For this analysis, we indexed revenue per available room (RevPAR) to 2007 for various key markets across Europe. This can be used to understand how markets were impacted in the short-term during the crisis, in the aftermath of the crisis and even further in the long-term to understand when markets recovered.

So how did hotel markets around Europe react?

London weathered the storm

London showed strong fundamentals and proved to be resilient. In fact, RevPAR increased in 2008 before dipping slightly in 2009 but did not look back from there with strong year-over-year growth through 2019.

Hotel demand in the U.K. capital is currently at an all-time low as the market suffers due to a reliance on international travel, which is nearly non-existent due to restrictions and lockdown measures. However, once international travel does return, we can perhaps expect a quicker long-term recovery in London as the city has proven it can weather a storm.

German markets dipped but recovered quickly

While other countries in Europe were being pulled further into crisis, Germany benefitted from its economic strength even during the crisis as well as being a mostly domestic market, which allowed hotel performance to recover quicker than others in Europe.

Economically, Germany remains a powerhouse in Europe, and its large domestic market has helped in boosting demand relative to other countries in Europe during this COVID period, so some optimism in a recovery can be taken regarding German markets.

Markets in weaker economies were more impacted

By 2009, hotels in Madrid and Dublin were among the most impacted. In the latter part of 2009, Spain and Ireland went through a debt crisis lasting several years leading to subdued economic growth in both countries as well as an increase in unemployment in Spain.

RevPAR in Madrid stagnated in the subsequent years following the GFC, and five years on from the crisis in 2012, RevPAR was almost 30% lower than pre-crisis levels. As the capital of Spain, Madrid sees substantial demand coming in the domestic corporate and leisure segment. A strong run of six consecutive years of RevPAR growth began in 2014 as Madrid benefitted from an increase in international arrivals and from hosting high-profile events, including the Champions League Final and COP 25 in 2019.

Madrid has stronger fundamentals and is more diversified than it was back in 2008, however, it will need to rely on a return of these lucrative segments to recover to pre-COVID levels.

RevPAR in Dublin five years on from the crisis in 2012 was just over 20% lower than it was pre-GFC as Ireland battled with suppressed economic growth domestically. Suppressed economic growth around the world impacted Dublin also as it is a market reliant on visitors from overseas.

RevPAR increased for eight years consecutively from 2011 through to 2018 as Dublin benefitted from substantial increases in international arrivals around the world, from the U.S. in particular, as well as close to no supply growth.

Future supply growth is expected to rise substantially as Dublin boasts a large pipeline of projects to enter the market. How Dublin responds to a current lack of demand as well as absorbing this new supply will be telling of its recovery. Dublin remains an attractive market for international visitors, and with plenty of new hotel offerings, it may recover from this current crisis quicker than it did during the GFC.

Conclusion

COVID-19 is a different crisis than what hotels faced during the GFC, as restrictions on travel and lockdown measures are severely impacting hotel demand. The GFC impacted performance, at a lesser rate, but key markets across Europe all eventually recovered. Some recovered faster than others due to a stronger economy or being domestic markets.

For markets to begin recovery, the threat of COVID-19 needs to be significantly mitigated. Once that happens, and destinations can begin to welcome to travellers to their hotels, we will see recoveries at different paces

Pandemic doesn’t dampen long-term hope in Israel

The pandemic has heavily hit the Israeli tourism sector, but the country’s hotels are likely to recover sooner than those in other countries of the Middle East.

TEL AVIV—The Israeli hotel industry was set for fast growth in the coming years on the back of record-breaking tourist flow in 2019, and sources believe the pandemic has slowed, but not stopped, that success story.

Israel hosted a record number of tourists in 2019, with around 4.55 million people visiting the country, compared to 4.1 million visitors in 2018 and 3.6 million in 2017, said the Israeli Tourism Ministry. Before the spread of COVID-19, that organization predicted an estimated 5 million foreign arrivals were due to come in 2020.

The pandemic has turned the tables, and some hoteliers are very stark in their analyses.

“The effect is worse than all the wars and operations Israel had gone through during the previous 15 years, combined,” said Avi Zak, managing partner of Drisco Hotel Tel Aviv.

“We went from nearly 100% occupancy to 0% in three to four days between 11 to 15 March and until the beginning of June this year. The overall occupancy of 2020 will be 30% to 50% lower than projected before the COVID-19 crisis.”

Tali Tenenbaum, VP of marketing at the Israel Hotel Association, said hoteliers have taken a massive hit.

“The hotel industry is the first to be hit and the last to recover,” she said. “The injury to the industry is fatal. Only about 63% of hotels have reopened since May 2020. In cities based on foreign tourism such as Jerusalem, Tel Aviv, Nazareth and Tiberius, the situation is even more difficult.”

Some managers preferred not to open their hotels, while others adjusted pricing.

“We have adjusted the rates and product to the local Israeli market, and since opening, we maintain a high level of occupancy at relatively affordable rates,” Zak said.

The demand environment remains week, said Estelle Hock, sales analyst lead and guest relations manager at Israeli-owned Atlas Hotels, which has 16 hotels in the country.

“Ninety-nine per cent of the hotels in Israel were closed for several months at the beginning of the pandemic. Many are still closed as non-Israelis tourists are not allowed to visit Israel,” she said.

Between January and July 2020, average occupancy in Tel Aviv amounted to 34.5%, down 55% year over year, according to data from STR, the parent company of Hotel News Now.

For the same period, the city’s average daily rate fell 29.9% to 672.50 ($194.69) Israel new shekel, and revenue per available room fell 68.5% to 231.70 ($67.08) new shekel.

Weighing the advantages

On 16 August, the Israeli government approved a bailout package for hotels at the cost of 300 million Israeli new shekels ($88 million), to be distributed in the form of grants.

Eligibility for those grants and amounts paid to each hotel is determined on each hotel’s slump in revenue compared with corresponding periods in previous years, the tourism ministry said.

Simon Hulten, the senior associate at business advisory HVS London, sees government interventions in Israeli as vital.

“The bailout package, including the cancellation of city tax, a furlough scheme which runs until June 2021, as well as grants to assist with running costs until next June, (is), as far as I know, more extensive than many other countries in Europe and will without a doubt be a key pillar to frame and assist existing hotels to stay afloat,” he said.

He said many countries and markets with less reliance on international demand and air travel had experienced stronger recoveries during the summer and would probably continue to do so going forward. That includes Israel, with more than 50% of its overnight demand deriving from domestic tourism, a percentage higher than many other countries in the Mediterranean region.

Sources said the bailout package will help hoteliers to make it through. Hulten said he anticipates the hotel industry would achieve pre-crisis performance around 2024.

The bailout package may be altered the longer the battle against COVID-19 lasts, said Tenenbaum, who added the pandemic appears to be a marathon, rather than a rally.

She said that when the dedicated grant was formulated in June, it was intended to help pay hotels’ fixed expenses on the assumption that towards the end of the year, inbound tourism would have recovered.

“No one imagined that the crisis would continue to hit us during 2021, and hotels will be closed again, so the support, which we hope will be received soon, does not compensate for the long period,” Tenenbaum said, who added the industry needed to further lobby government.

Some hoteliers, though, are not counting on much state aid.

“The bailout package is something we are not looking at or looking for. We work harder now to pay all our debts and be able to provide our employees with as many jobs as possible. If we got something, I would be highly surprised. I assume that we will see some kind of improvement in one year and return to 2019 numbers in 2022,” the Drisco Hotel Tel Aviv’s Zak said.

Tenenbaum said despite the pandemic’s effect on investment attractiveness, in the last month new hotels have launched.

She said Israeli hoteliers are very skilled at dealing with crises and unprecedented challenges.

“Israel’s hoteliers have an exceptional experience on how to thrive in periods of uncertainty, perhaps more than any other country, and have demonstrated the value of being agile and successful in challenging environments,” she said.

“Although this crisis is unprecedented, this mindset and the ability to adapt to new circumstances are definitely in Israel’s favor when looking at potential recovery curves,” Hulten added.

Source: https://www.hotelnewsnow.com/Articles/304697/Pandemic-doesnt-dampen-long-term-hope-in-Israel